In today’s fast-paced world, ridesharing has become an integral part of our daily lives. Whether you’re a passenger looking for a convenient ride or a driver seeking to earn some extra income, ridesharing apps like Uber and Lyft have revolutionized transportation. However, as with any innovation, there are risks involved, and it’s essential to understand the importance of rideshare insurance.

Understanding Rideshare Insurance

What is Rideshare Insurance?

Rideshare insurance, also known as “rideshare coverage” or “ride-hail insurance,” is a specialized type of auto insurance designed to protect both drivers and passengers while using ridesharing services. It fills the gap between personal auto insurance and the commercial insurance provided by ridesharing companies.

Why Do You Need Rideshare Insurance?

The need for rideshare insurance arises because personal auto insurance policies typically do not cover accidents that occur while using your vehicle for commercial purposes. Without proper coverage, you could find yourself in a financial and legal bind if an accident were to happen during a rideshare trip.

The Key Benefits of Rideshare Insurance

1. Full Coverage Assurance

Rideshare insurance ensures that you are covered from the moment you log into a ridesharing app until you end the trip. This comprehensive coverage guarantees peace of mind, knowing that you won’t face financial hardships due to accidents.

2. Protection for Passengers

It’s not only rideshare drivers who benefit from this insurance; passengers are also safeguarded. In case of an accident, medical expenses and liability claims are covered, ensuring that passengers receive the care and compensation they deserve.

3. Legal Compliance

Many states and ridesharing platforms require drivers to have appropriate insurance coverage. Rideshare insurance helps you comply with these regulations, preventing potential legal issues and fines.

How Rideshare Insurance Works

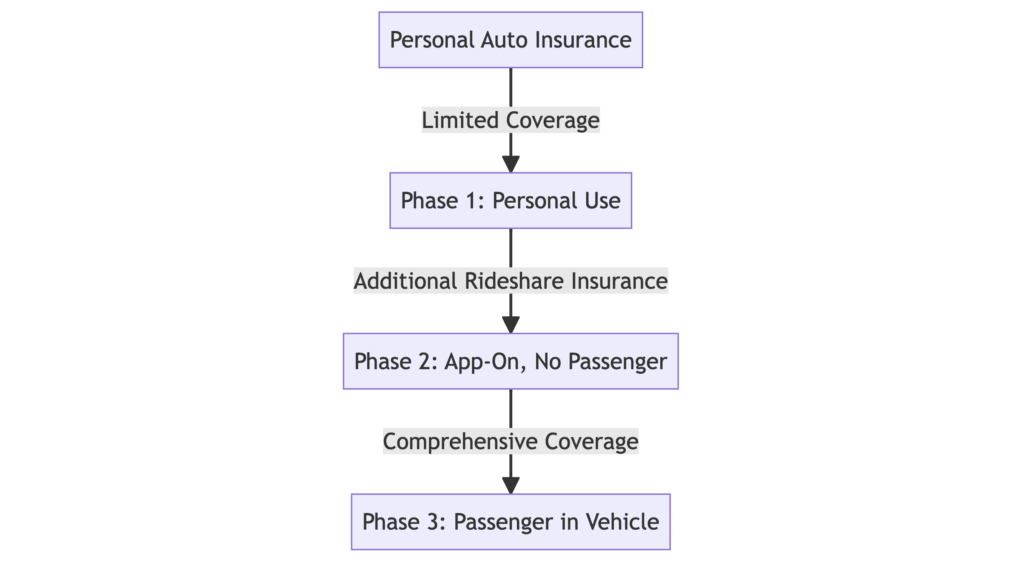

Rideshare insurance typically functions in three stages:

Stage 1: Personal Use

During this stage, your personal auto insurance covers you as you use your vehicle for non-commercial purposes. This includes driving to the grocery store or visiting friends.

Stage 2: App On, No Passenger

Once you log into a ridesharing app but haven’t accepted a ride request, your rideshare insurance comes into play. It provides coverage for potential accidents during this phase.

Stage 3: Passenger in Vehicle

When you have a passenger in your car, the ridesharing company’s insurance usually takes over, providing additional protection for both you and your passenger.

Choosing the Right Rideshare Insurance

Factors to Consider

When selecting rideshare insurance, consider the following:

Coverage Limits

Ensure that your policy offers sufficient coverage to protect you in various scenarios, including accidents with passengers and uninsured motorists.

Deductibles

Evaluate the deductibles associated with the policy. A higher deductible may lead to lower premiums but require more out-of-pocket expenses in case of a claim.

Cost

Compare quotes from different insurance providers to find a balance between cost and coverage.

Conclusion

Rideshare insurance is a vital investment for both drivers and passengers. It bridges the insurance gap created by personal auto policies and the commercial nature of ridesharing services. By ensuring you have the right coverage, you can enjoy the convenience of ridesharing while protecting yourself and others on the road.

FAQs

- Is rideshare insurance mandatory for drivers? Rideshare insurance is not always mandatory, but it is highly recommended to ensure you are adequately protected while driving for a ridesharing service.

- Can I add rideshare insurance to my existing policy? Many insurance companies offer rideshare endorsements that can be added to your existing policy, making it a convenient option.

- Do rideshare companies provide insurance for their drivers? Rideshare companies typically offer insurance coverage, but it may have limitations. Rideshare insurance supplements this coverage to ensure comprehensive protection.

- Is rideshare insurance expensive? The cost of rideshare insurance varies depending on factors such as your location, driving history, and the insurance provider. It’s advisable to compare quotes to find an affordable option.

- What should I do if I’m involved in an accident while ridesharing? If you’re in an accident while ridesharing, ensure everyone’s safety, contact the authorities, and report the incident to your rideshare company and insurance provider promptly.