Buying a new car is an exhilarating experience, but before you zoom off the lot, have you considered getting car insurance? It’s a crucial step often overlooked in the excitement of purchasing a vehicle. In this article, we’ll delve into the reasons why getting car insurance before buying a car is essential and how to make an informed choice when selecting the right coverage.

Understanding Car Insurance

Car insurance comes in various types, each offering different levels of coverage. The common types include liability insurance, collision insurance, comprehensive insurance, and uninsured/underinsured motorist coverage. Understanding what each type covers is essential in making an informed decision.

Factors Influencing Car Insurance

Your driving history, location, the type of car you’re buying, and your age can significantly influence your car insurance rates. Insurers assess these factors to determine the level of risk they’re undertaking by insuring you.

Importance of Preparing

Before you drive off in that new car, it’s crucial to have your insurance sorted. Accidents can happen at any time, and being prepared with insurance ensures that you are financially protected in case of a mishap.

- Legal Requirement: In numerous regions, having car insurance is mandatory before you can legally drive a vehicle. By securing insurance before buying a car, you adhere to legal requirements.

- Financial Protection: Accidents can happen at any time, even before you’ve officially purchased the car. Having insurance in place ensures you’re financially protected from any liabilities that may arise.

How to Choose Car Insurance

Selecting the right insurance involves considering factors like the coverage you need, your budget, and the reputation of the insurance provider. It’s essential to tailor your insurance to your specific needs and circumstances.

Learn more about different type of coverages and know how much coverage is enough for you: Comparing auto insurance policies

There are different ways you can save on car insurance: Check different ways to save on car insurance

Understanding Policy Terms

Car insurance policies often come with a host of terms and jargon that can be confusing. Familiarize yourself with these terms to understand your policy better and avoid any surprises when you need to make a claim.

Budgeting for Car Insurance

Car insurance is an ongoing expense, so it’s crucial to budget for it accordingly. Explore options to make your insurance more affordable without compromising on essential coverage.

Compare car insurance quotes

To get the best deal on car insurance you can shop around to compare car insurance quotes. Or you can get insurance rates online in 60 second using our online quote comparison tool.

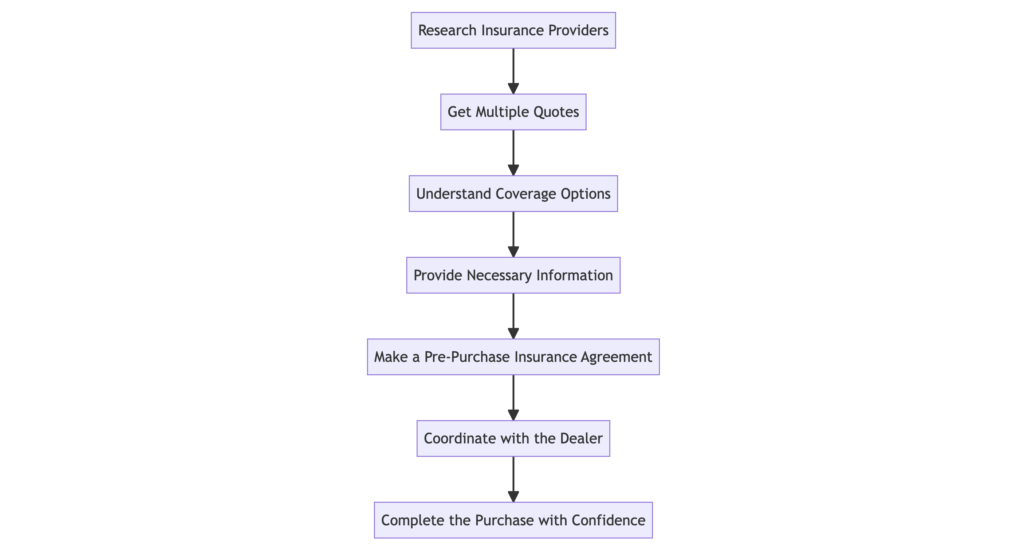

Insuring your new car in a nutshell

Frequently Asked Questions

- Is car insurance mandatory before buying a car?

Yes, most states require you to have car insurance before you can legally drive a car.

- Can I transfer my existing car insurance to a new vehicle?

Yes, you can typically transfer your current insurance policy to your new car.

- What factors affect my car insurance rates?

Factors like your driving history, location, type of car, and coverage type can influence your rates.

- Can I change my insurance coverage later?

Yes, you can adjust your coverage at any time to better suit your needs.

- What should I do if I’m in an accident before getting insurance?

If possible, get insurance as soon as possible, but in the meantime, contact the insurance company to arrange coverage retroactively.

Getting car insurance before buying a car is a wise decision that ensures you’re protected on the road. It’s an essential step that provides financial security and peace of mind, allowing you to enjoy your new ride worry-free. So, before you hit the road, make sure you’re covered.